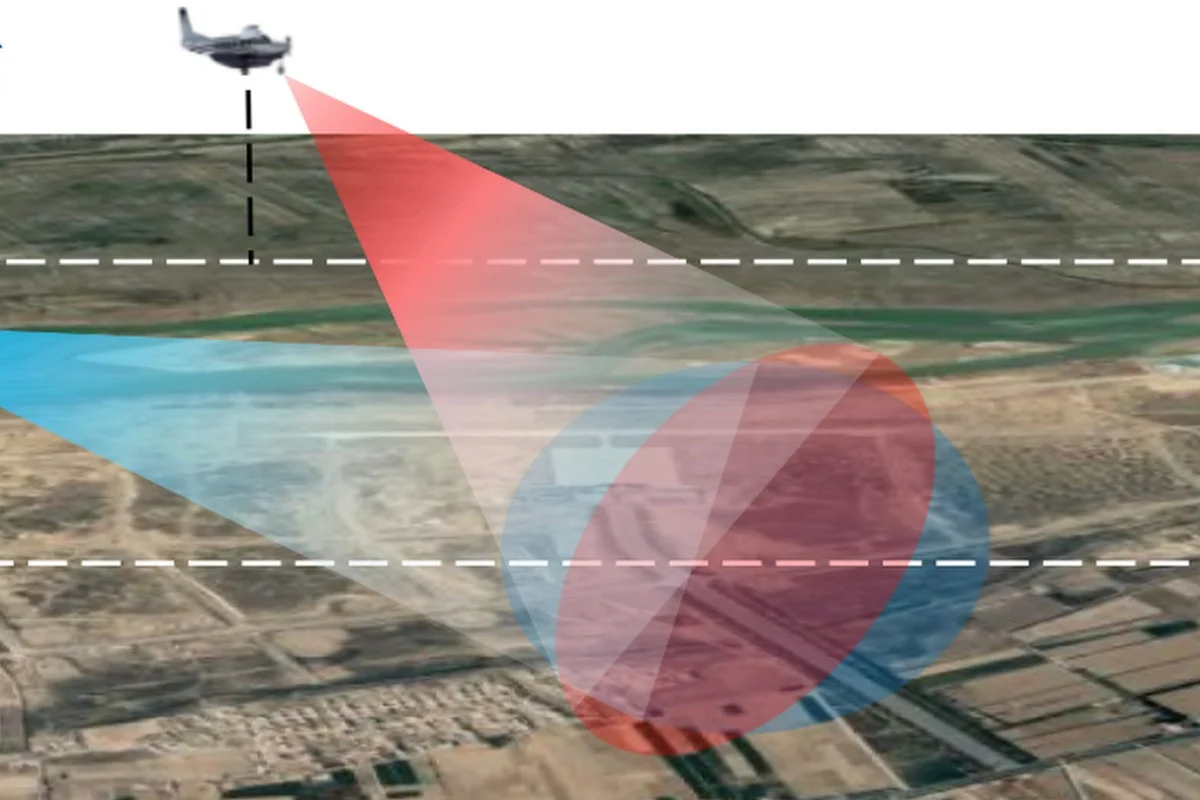

China’s 2025 military parade in Tiananmen Square revealed more than new weapon systems; it underscored Beijing’s dominance in gallium nitride (GaN) semiconductors. A report by the Chinese Academy of Sciences highlighted that China has reached maturity in GaN-based technologies, enabling large-scale deployment of phased array radars across platforms such as the KJ-500A airborne early warning aircraft and the Type 100 tank. Unlike Washington’s overt chip restrictions, Beijing’s “silent sanction” exploits its near-monopoly on gallium and germanium—critical raw materials essential for next-generation defense electronics.

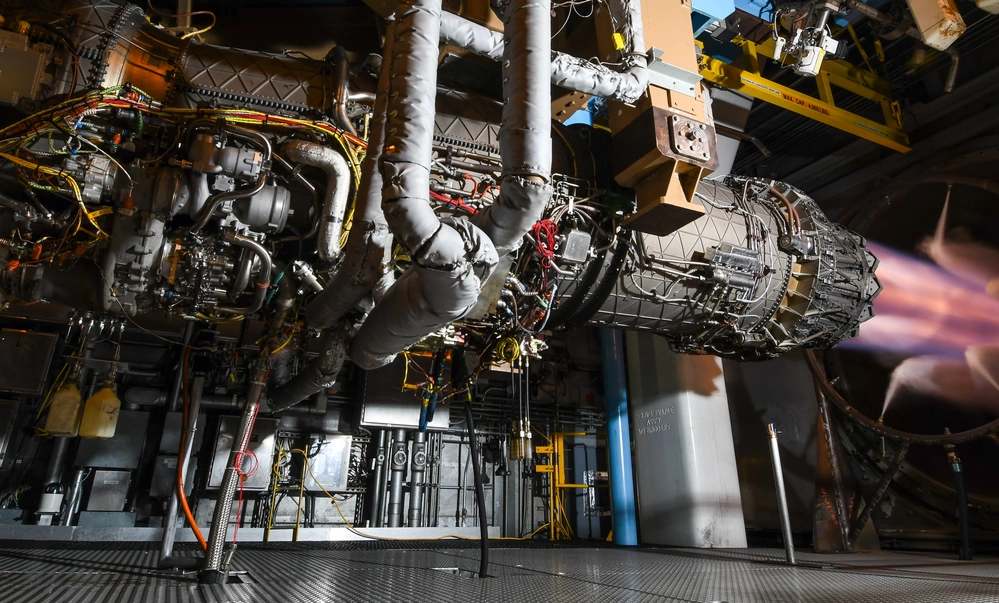

GaN, classified as a third-generation semiconductor, offers power densities five to ten times higher than gallium arsenide (GaAs), allowing radar systems to achieve greater detection range, resolution, and efficiency while reducing maintenance costs. By electronically controlling the emission phase of each radar transmitter, phased array systems achieve rapid beam steering, multi-target tracking, and improved reliability compared to mechanically steered or older PESA radars. China’s ability to mass-produce 8-inch GaN wafers and integrate them across civilian and military applications exemplifies its military-civil fusion strategy, where commercial demand in 5G, electric vehicles, and drones accelerates defense innovation.

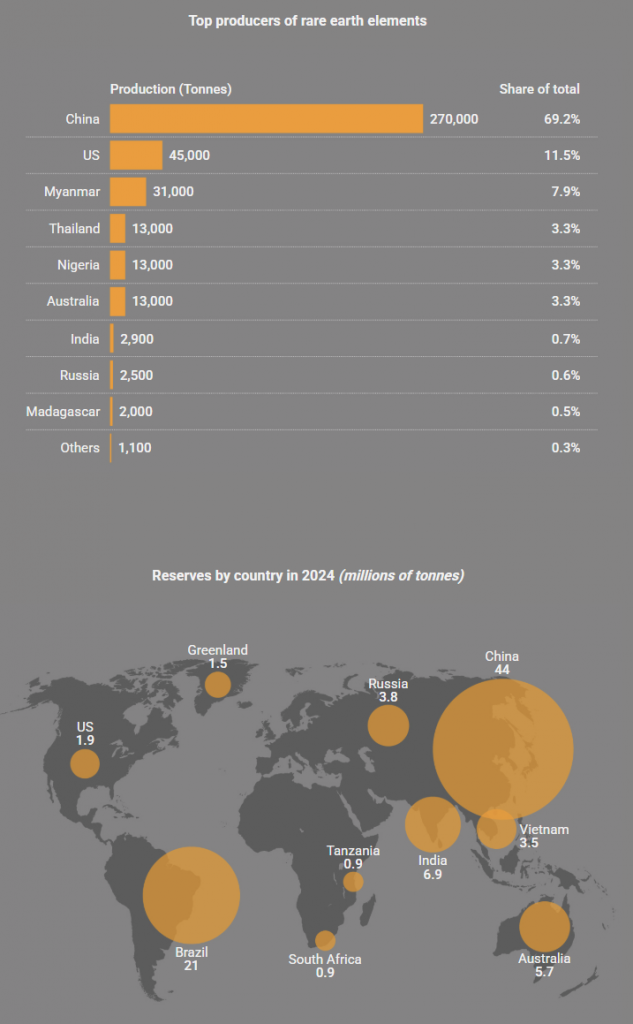

At the core of this advantage lies China’s dominance in the gallium supply chain. Accounting for 68% of proven reserves and over 90% of refined gallium output in 2023, China cemented its position with export controls in 2023 and 2024. Parallel to this, Beijing’s new industrial action plan mandates domestic production of critical components and resilient supply chains, targeting 7% annual growth in electronics manufacturing. Together, these measures not only fortify China’s self-sufficiency but also create a generational gap in radar and semiconductor technologies that the United States is struggling to close.

Share this content:

Leave a Reply